Often driven by financial independence, people look at means of getting passive income. Stable returns and low risk make Fixed Deposits (FDs) among the most sought after investment tools in India. One distinctive aspect drawing many investors among the several FD plans banks provide is the option to get monthly payouts. This essay examines how an essential tool for creating a good passive income plan, the FD Calculator Monthly Payout, can be used.

Knowing Fixed Deposit (FD) Plans

Offered by banks and nonbanking financial institutions (NBFCs), fixed deposit plans allow people to deposit a set amount for a fixed period. tenure at a predetermined interest rate. The scheme determines whether the accrued interest is reinvested, added to the principal amount at the end of the term, or distributed monthly, quarterly, or yearly.

For those seeking passive income, FDs are especially appealing since monthly payments are available. Younger people might use FD payouts to cover specific costs like EMIs, utilities; retirees, for instance, might choose monthly payments to augment their pension. bills or savings for future plans.

How an FD Calculator Monthly Payout Aids Your Planning

Online tool called an FD Calculator Monthly Payout lets you project your monthly income from an FD. It presents a straightforward analysis of your possible earnings, hence investors may evaluate and develop a plan for passive income.

Important FD calculator inputs

You must provide some vital information to utilize an FD calculator:

- The lumbsum amount you mean to deposit is known as principal amount.

- Announced interest rates vary across banks and NBFCs depending on the issuer and tenure of the FD.

- The period of time you plan to store your money in the fixed deposit programme—usually ranging from 7 days to 10 years.

- Monthly, quarterly, half-yearly, or annual payments are the payout frequency.

Entering these specifics, the FD calculator quickly computes your monthly compensation, therefore assisting you in determining the viability of reaching your passive income objectives.

Determining Monthly Income Using FD Calculator: Instance

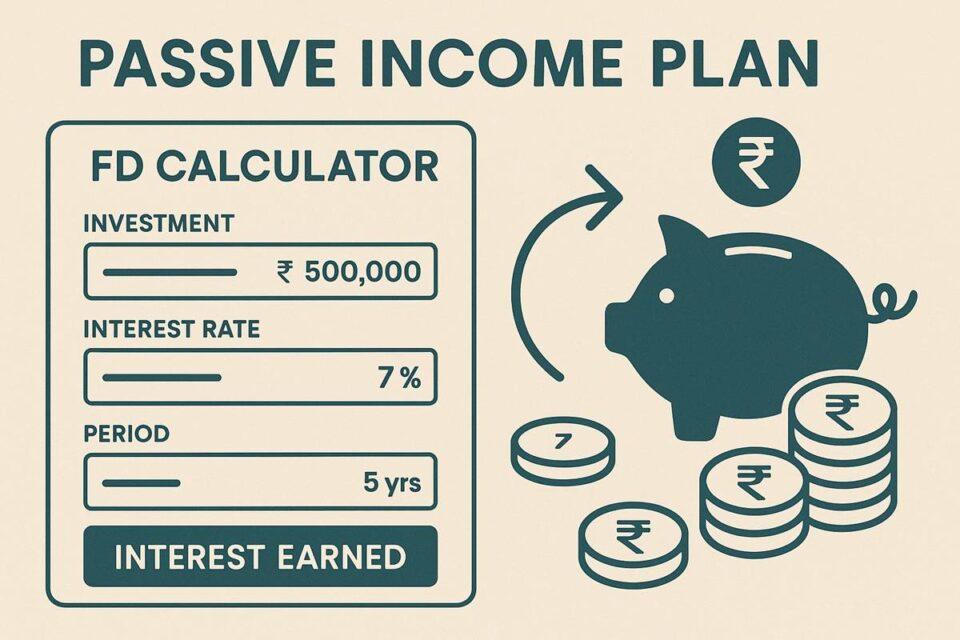

Let’s consider the following situation to demonstrate the value of an FD calculator monthly payoff:

- Rs 5,00,000 is the principal amount.

- 7.5% per year interest rate

- Tenure: 5 years

- Payout Frequency: Monthly

- Formula Used in FD Computation

- You may compute monthly payments using the equation:

- [ Monthly Payout = frac{Principal Amount times Interest Rate}

- Computational Work

- Monthly Payout equals five lakh rupees times seven and a half percent divided over twelve.

- [ text{Monthly Payout} = frac{₹37,500}{12} = ₹3,125 ]

Important Advantages of Creating Passive Income with Monthly Payout FD Plans

#1. Anticipated Revenue

Monthly payouts under FD programs guarantee steady, expected income. Investors can plan their monthly costs well thanks to this tool, which removes doubts on market conditions.

#2. Investment at low risk

Because they are not affected by market swings, FDs have very little risk compared to market-linked instruments like stocks or mutual funds. The original value is safe; FD rates are set.

#3. Payment frequency’s convenience

Choosing regular payouts improves liquidity, therefore FDs are practical for senior citizens, homemakers, and even young professionals supplementing their income.

Things to think about while selecting FD monthly payout plans

While fixed deposits offer a great chance for passive income, investors need to take into account several elements before committing in any monthly payout FD scheme.

1. Rates of interest

FD interest rates vary widely among banks. Senior citizens usually have higher interest rates, hence monthly payout FD schemes seem much more appealing for them.

2. Tax Deduction at Origin (TDS)

According to Indian rules, TDS is attracted on interest income over ₹40,000 in a financial year (₹50,000 for senior citizens). This can affect your real income, therefore it’s critical to consider tax consequences before choosing an FD plan.

3. Restrictions on liquidity

Once the principal is fixed into an FD, early withdrawal usually results in fines. Though the principal amount is unavailable until maturity, monthly payout plans offer liquidity in the form of regular interest payouts.

4. Compound Factor

Compounding, whereby earned interest is readded to the principal, some FD programs provide for in following months or years more rewards. Think carefully about whether or not the FD program includes compounding.

5. Consequences of inflation

Though FDs guarantee fixed returns, high rates of inflation might lower your income’s actual worth. Locking funds at a 5% interest rate over the next five years, for instance, and inflation reaching 6% may lead to a loss of real purchasing power.

From a long-term perspective, use of FD monthly payout for passive income helps.

You have to evaluate your financial obligations, goals, and risk tolerance if you want to develop a long-lasting passive income plan. Many investors split their financial portfolios by putting money into several FD programmes with staggered maturities to boost liquidity and ensure steady cash flow.

Valuing Constraints and Dangers

Though appealing, FD monthly payment plans have problems:

- Less suitable for high-risk/high-return investors as fixed deposit interest rates usually are lower than profits from equity markets or mutual funds.

- The interest received from FDs is entirely taxable, hence lowering total revenues.

- Fixed-income products like FDs lack the exponential development possibilities seen in equity-based investments. Moreover, inflation could be greater than interest rates.

Briefly:

Even though FD monthly payment schemes are straightforward and lowrisk, investors have to consider tax implications, the effect of inflation on purchasing power. power, and the limitations of fixed returns. Moreover helping passive income strategies is the diversification of investments over many FD projects with phased maturities.